Using Reporting Currency

Use the Reporting Currency when a company in your org reports to an intermediate parent company that uses a Home currency different from the Dual currency set by your corporate headquarters. In most cases you can use the reporting currency the same way you select a Home or Dual currency for a process.

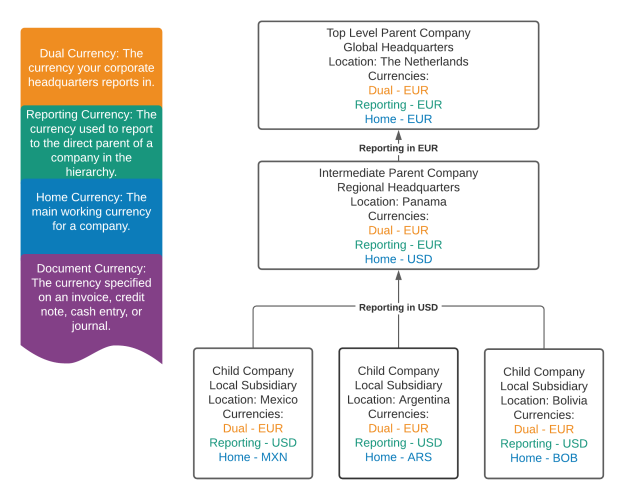

For example, in the following chart you can see consolidating and reporting up an organization's hierarchy using the Reporting Currency to consolidate with a regional headquarters and from there using the Dual currency to consolidate with the corporate headquarters.

Automated Eliminations

When creating a new automated elimination you can select the Use Reporting Currency checkbox to override the default currency for the elimination. For more information, see Creating an Automated Elimination.

Reporting Currency from Currency Revaluation

Performing a Currency Translation to Reporting works the same as a regular translation to Dual, the only difference is that instead of using the Dual Currency, the translation process uses the currency exchange rate for your selected reporting currency. For more information, see About Currency Revaluation and Translation.

Reporting Currency on Transactions and Accounting Documents

Using the Reporting Currency on transactions, Accounting documents and performing currency overrides from the journal header works the same as using the Dual currency in these contexts. Ensure you select the Reporting Currency Rate when prompted by the processes. For more information, see About Currency Overrides on Journals also What is a Transaction?.

Reporting Currency on Cash Entries

Performing currency overrides from the cash entry header works the same as using the Dual currency in this context. Ensure you select the Reporting Currency Rate when prompted by the processes. For more information, see Overriding Exchange Rates When Creating Cash Entries.

SECTIONS

SECTIONS