Overview

Fixed Asset Management enables you to manage the assets in your organization, calculate depreciation schedules for them and post depreciation schedules as journal entries to an accounting system such as Accounting. You can track the assets in your organization over their entire lifecycle from their acquisition through to disposal.

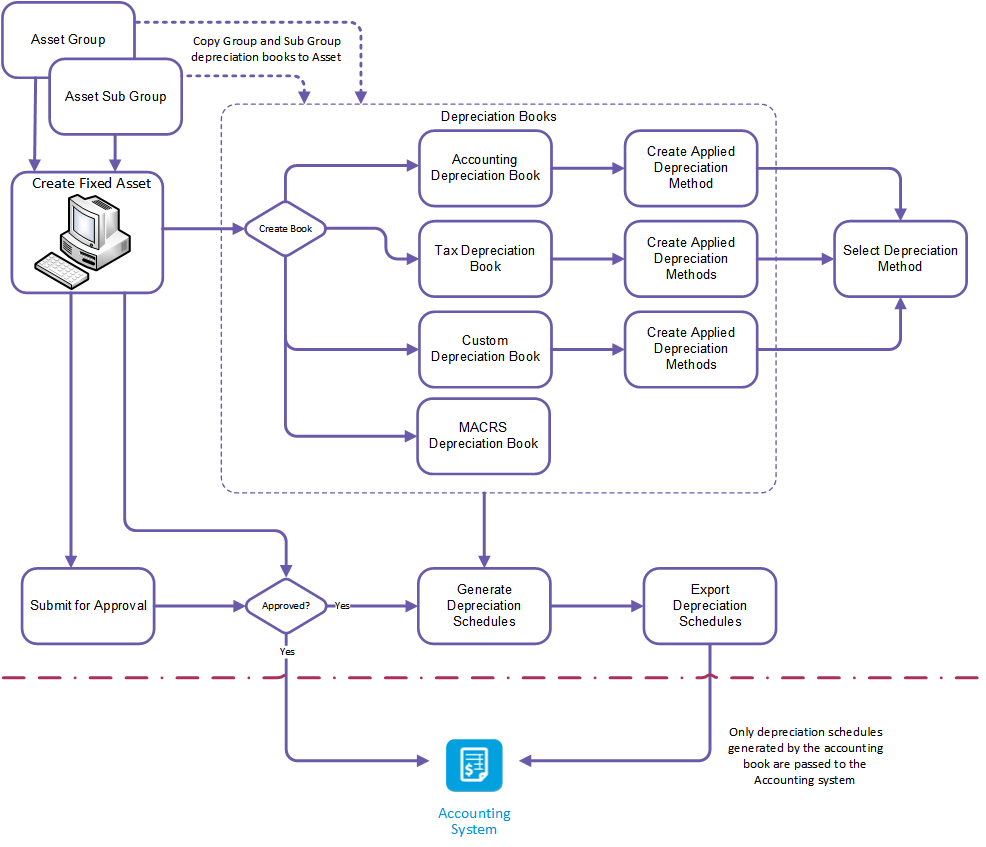

The diagram that follows provides a basic overview of the way in which you can create assets and generate depreciation schedules for them.

Click a box in the diagram to display a corresponding topic. To return to this page, click this page in the contents pane or the back button on your browser.

SECTIONS

SECTIONS