Revenue Management System Overview

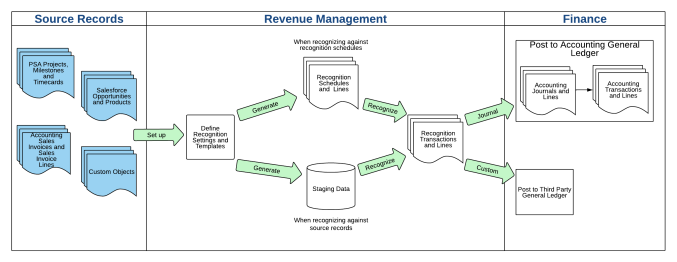

You can use Revenue Management to recognize revenue and cost for source records. Your source records might be PSA projects and milestones, other Certinia records, or records for custom objects. You make your source records available to Revenue Management by defining recognition settings for your source objects, and applying recognition templates to each source record. Revenue Management can then read information from your source records, calculate how much revenue or cost to recognize, and create recognition transactions which you can optionally post to Certinia Accounting or a third party system. This is illustrated below.

The diagram shows that there are two ways of recognizing revenue and cost in Revenue Management: against recognition schedules or against source records. Recognition schedules are intermediate records that Revenue Management creates from your source records to manage the recognition process. Prior to the introduction of recognition schedules, revenue and cost amounts were recognized directly against source records with Revenue Management generating temporary staging data to support this process. This earlier recognition process is sometimes known as Actuals Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process..

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process..

We recommend you set up Revenue Management to use recognition schedules rather than Actuals Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. because:

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. because:

- Recognition schedules provide forward-looking data, letting you see how much revenue or cost will be recognized over the lifetime of a source record. You can generate recognition schedules as soon as a source record is created. This means that you have information to report on a company's future revenue position without needing to run a forecasting or recognition process.

- You can configure your setup to display recognition information directly on your source records via related lists of recognition schedule lines, or by configuring cards to display KPI values. Opportunities for reporting are also improved because of the information held on recognition schedules and lines.

- On the Revenue Recognition page, you can view scheduled revenue and cost per period for all your companies, currencies, and recognition streams in one place. Filtering options allow you to control the information displayed, and to recognize only the revenue and cost amounts that are displayed.

- You can automate your recognition schedule processes from generating schedules and running the recognition process, through to optionally summarizing the resulting transactions and creating Accounting journals. You can schedule your automation configurations to run at regular intervals, reducing the number of manual steps required to complete your recognition processes.

- Generating recognition schedules performs faster and supports higher volumes than generating staging data for Actuals

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. which uses older technology and is no longer being actively developed.

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. which uses older technology and is no longer being actively developed. - All new development is being done around recognition schedules. No new development is being done around the Actuals

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. functionality.

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. functionality.

Further Information

If you are installing Revenue Management for the first time, see Getting Started with Recognition Schedules.

If you are upgrading and want to migrate to using recognition schedules, see Migrating from Actuals to Recognition Schedules.