Calculating Tax and Posting to Accounting

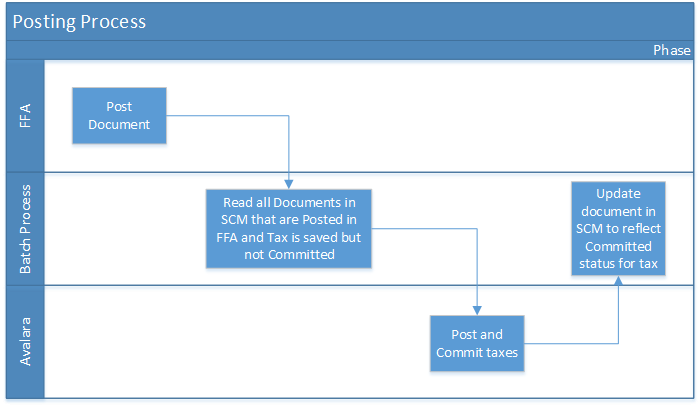

Taxes are not final in Avalara AvaTax until they are committed. When an Accounting document that was created from an Order and Inventory Management document is posted, tax is not automatically committed in Avalara for the Order and Inventory Management document. An additional process must be run to commit the taxes for the Order and Inventory Management document. This can be done manually or automatically, though a scheduled job.

The following diagram provides an overview of the posting process in relation to Avalara and Accounting.

Batch processes are available to post and commit taxes in Avalara after the document is posted in Accounting. These processes can be scheduled to run as recurring background jobs. We recommend that you schedule these processes to run as frequently. This ensures that the taxes are sync in all three system.

The batch processes are available for Order and Inventory Management invoices and credit invoices.

There is support for invoking Avalara for Use Tax on AP Vouchers but as these types of transactions are rare there is no automation process. The user must specifically Calculate Tax on the AP Voucher when it is needed and then go back and Post and Commit the tax in Avalara from the AP Voucher after the Payable Invoice is posted in Accounting.

Scheduling the Batch Processes

There is a custom setting installed with the package called OIM – Avalara – Accounting Settings. In here you can specify if you want the Post and Commit process to be scheduled again when it finishes and the interval before it starts again. To enable this, check the appropriate Schedule Post Commit option and specify an interval.

Document Status

Avalara manages taxes in multiple statuses so that all the systems remain in sync.

The statuses are as follows:

- "Inquiry"

- "Saved"

- "Posted"

- "Committed"

Invoices, credit invoices, AP vouchers, and AP credit vouchers go through the "Saved", "Posted", and "Committed" statuses.

SECTIONS

SECTIONS