When using the Use Whole Month Threshold proration calculation, Billing Central calculates how many whole months are in the partial period, then:

The formula used to calculate the prorated value for the partial period is:

Sales Price * ((W+R)/Z)

where:

|

Line Start Date |

Line End Date |

Billing Term |

Line Sales Price |

First Billing Period |

Final Billing Period |

|---|---|---|---|---|---|

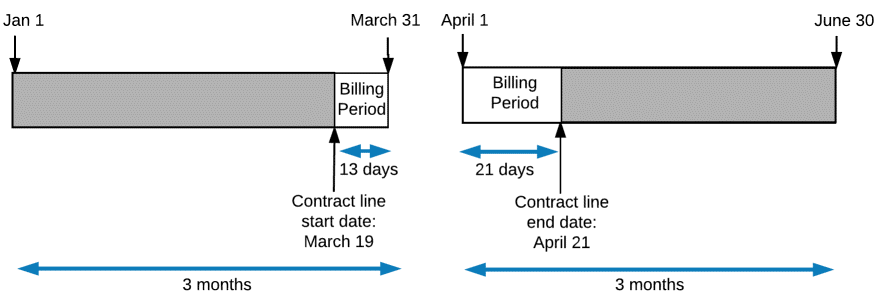

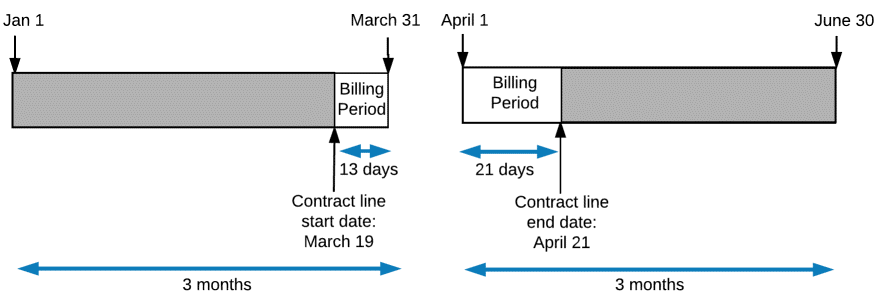

| Sun, March 19, 2017 | Fri, April 21, 2017 | QB | $90 |

March 19 to March 31 = 13 days W = 13/30.4 rounded down to a whole number = 0 with 13 remainder 13 < 16 so R = 0 Jan 1 to March 31 = 3 months $90 * (0/3) = $0 |

April 1 to April 21 = 21 days W = 21/30.4 rounded down to a whole number = 0 with 21 remainder 21 > 16 so R = 1 April 1 to June 30 = 3 months $90 * (1/3) = $30 |

|

Line Start Date |

Line End Date |

Billing Term |

Line Sales Price |

First Billing Period |

Final Billing Period |

|---|---|---|---|---|---|

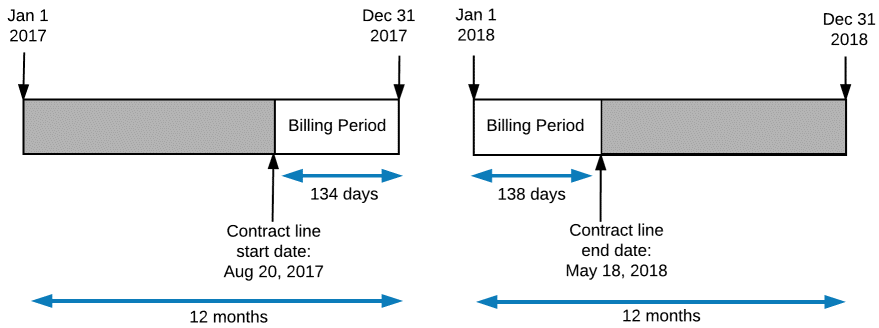

| Sun, Aug 20, 2017 | Fri, May 18, 2018 | YB | $120 |

Aug 20 to Dec 31 = 134 days W = 134/30.4 rounded down to a whole number = 4 with 12.4 remainder 12.4 < 16 so R = 0 Jan 1 to Dec 31 = 12 months $120 * (4/12) = $40 |

Jan 1 to May 18 = 138 days W = 138/30.4 rounded down to a whole number = 4 with 16.4 remainder 16.4 > 16 so R = 1 Jan 1 to Dec 31 = 12 months $120 * (5/12) = $50

|

View Tutorial

View Tutorial

Related Concepts

Calculating Actual Day Proration

Calculating 30 Days per Month Proration

Adjusting Final Period Value to Remainder from First Period

Custom Proration Calculation Methods

Related Tasks

Assigning a Proration Policy to a Contract

Assigning a Proration Policy to Multiple Contracts

Reference