Migrating from Actuals to Recognition Schedules

This information is intended for existing Revenue Management customers who want to migrate from using Actuals Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to using recognition schedules. If you are a new Revenue Management customer, please read Getting Started with Recognition Schedules.

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to using recognition schedules. If you are a new Revenue Management customer, please read Getting Started with Recognition Schedules.

For information about why we recommend you use Revenue Management with recognition schedules, see Revenue Management System Overview.

Before You Migrate

Before you migrate from Actuals Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to recognition schedules, be aware of the following points:

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to recognition schedules, be aware of the following points:

- Recognition transactions created from recognition schedules are grouped according to the Company field mapping rather than the Grouped By field mapping on a source object's recognition settings.

- Once you have switched to using recognition schedules, you cannot discard recognition transactions that were created when recognizing revenue and cost against source records (via staging data).

- Recognition templates must have a revenue basis of Total Revenue, or a cost basis of Total Cost. Recognition schedules are not generated for source records with templates using a different revenue basis or cost basis.

- Recognition schedules are not generated for source records that have a "Use in Revenue Contract" recognition template

A recognition template that has the Use in Revenue Contract checkbox enabled.. This is because recognition schedules will be generated against a revenue contract's performance obligations, not against the source records directly.

A recognition template that has the Use in Revenue Contract checkbox enabled.. This is because recognition schedules will be generated against a revenue contract's performance obligations, not against the source records directly.

Migration Steps

Take these steps to migrate from Actuals Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to recognition schedules:

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process. to recognition schedules:

- Using Actuals

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process., recognize all revenue and cost up to your chosen cutoff date (such as December 31, 2023). Commit the resulting recognition transactions. You must check any transactions that you commit because you will not be able to delete them once you switch to using recognition schedules.

Refers to the original revenue recognition process where staging data is generated for source records. The Recognize Revenue page and Recognize All use this process., recognize all revenue and cost up to your chosen cutoff date (such as December 31, 2023). Commit the resulting recognition transactions. You must check any transactions that you commit because you will not be able to delete them once you switch to using recognition schedules. - Check if there are any "In Progress" recognition transactions in your org. If any exist, delete or commit them. You must check any transactions that you commit because you will not be able to delete them once you switch to using recognition schedules.

- In Feature Console, ensure you have enabled all the upgrade features up to the current version.

- Complete the setup tasks explained in Additional Setup for Recognition Schedules. This explains how to create the required lookups and how to complete recognition settings specifically for using recognition schedules.

- In Feature Console, enable the Recognize against Recognition Schedules feature but skip the step to set the Global Opening Balance Cutoff Date.

- In the Revenue Management Settings custom setting, set the Global Opening Balance Cutoff date to the date you chose in step 1. For more information about opening balances, see Opening Balances for Recognition Schedules.

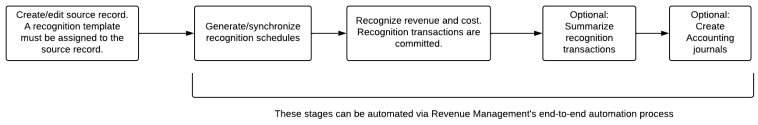

You can now generate recognition schedules, run the recognize process, and optionally post the resulting recognition transactions to Certinia Accounting (via the RT to Journal Integrations) or to a third party financial system. You can automate some of these stages as shown in the diagram below:

For more information about end-to-end automation, see End-to-End Automation of Recognition Schedule Processes.