KPIs Table

The following table contains a summary of the KPI groupings which are available and their associated KPIs.

| KPI Grouping | KPI | Description |

|---|---|---|

| Profitability | EBITDA |

The information for these values is derived from the Transaction Line Item, and from the Dual or Home values as specified on the filter panel for each dashboard. The data is further filtered by the dimensions selected on the dashboard configuration page. The calculation also takes into account the selected year or period for comparison with the current values using the following formula: Round((Current Value - Previous Value) / Absolute(Previous Value), 2) |

| Gross Margin | ||

| Operating Expenses | ||

| Revenue | ||

| Balance Sheet | Accounts Payable | |

| Accounts Receivable | ||

| Cash & Equivalents | ||

| DSO (Daily Sales Outstanding) |

Days Sales Outstanding is used to measure how up-to-date a company is with their accounts receivable collections. A low DSO value means the company takes fewer days to collect their accounts receivable. DSO is calculated as follows: (Accounts Receivable balance at end of the period / Revenue for the period) * Number of days in the period. The number of days is calculated by subtracting the period start date from the period end date, plus 1. For example: (10000 / 5000) * 30 = 60. |

|

| Subscription Bookings | Net New | If the Opportunity Type = "New Customer" + the contract status is not "Superseded", then the contract line item Monthly Recurring Revenue (MRR) is displayed as "Net New". |

| Starting ARR or MRR | The value of contract line items that are active on the day before the start of your specified date range. | |

| Upsell |

This is calculated using the following formula: If the Opportunity Type = "Existing Customer - Upgrade", then this is displayed as "Upsell". If the value of the previous contract line item is known, or if the value of the previous contract line item is less than the current value of the contract line item, then the difference between these two values is also displayed as "Upsell". |

|

| Down Sell |

This is based upon contract line items that have been renewed with the same product and billing type. "Down Sell" is calculated using the following formula: If the Opportunity Type is not "Existing Customer - Upgrade" + the previous contract line item is known, and has an MRR value greater than the value of the current contract line item, then the MRR of the previous contract line item is subtracted from the MRR value of the current contract line item and is displayed as "Down Sell". |

|

| Churn |

This identifies contract line items that have not been renewed, and is calculated using the following formula: If the next contract line item is "Unknown" + and the contract status is not "Superseded" + the next opportunity is "Unknown" + the end date is not null, then the contract line item MRR value is displayed as "Churn". |

|

| Contract Adjustments |

This KPI identifies the contract line items which have been changed by the replacement process, with the Opportunity Type "Replacement". Contract Adjustments subtracts the MRR value of contract line items on an adjusted contract from the previous version of the contract. It is calculated using the following opportunity types, contract statuses and the Contract Adjustments Replaced and Contract Adjustments Replacement calculated fields. For more information on these fields, see Billing Contracts Dataset Output Fields. Calculation: If the Opportunity Type = "Existing Customer - Replacement" + the Contract Status is not "Superseded", then this contract line item MRR is defined as an adjusted contract, and given a positive value. If the value of the Next Opportunity Type = "Existing Customer - Replacement", then the MRR value of the adjusted contract is added to the previous version of the contract. The adjusted contract is given a negative MRR value. Example calculation:

Result:

|

|

| Unaccounted Error |

This displays the number of days between the end date of a previous contract and the start date of its renewal. It is calculated using the following formula: Ending MRR - Starting MRR + all KPIs. |

|

| Renewals |

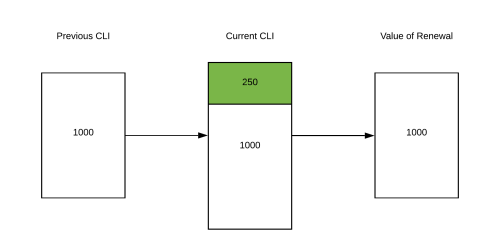

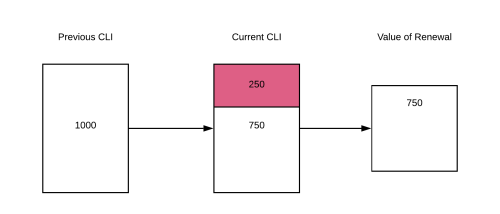

This is based on value of contract line items renewed between your specified range of dates. The "Renewal" KPI is calculated using the following formula: Opportunity Type= "Existing Customer - Renewal" + Status= not "Draft" + not "Superseded" is displayed as "Renewal". The value of "Renewal" is derived from the difference in value between the current Contract Line Item and the Previous contract line item. The lowest value is displayed as the renewal value.  Example Example

|

|

| Ending ARR or MRR | The value of contract line items that are active on the end date of your specified date range. | |

| CLI MRR | The monthly recurring revenue value as calculated by the contract value in the Contract Line Item object. | |

| Closed Renewals | The MRR amount of the renewals that are closed or about to be, calculated as: Sum of CLI MRR where Next Opportunity is not Unknown and Contract End Date = Current Quarter or Next Quarter. | |

| Net New MRR | The amount of monthly recurring revenue gained from new contracts this quarter, calculated as: Sum of MRR for net new contracts with a Contract Start Date = Current Quarter. | |

| Contract Churn | The number of customer contracts that have withdrawn their subscription, calculated as: Count of non-superseded contracts where the Contract End Date = Last Quarter, and Next Opportunity Name = Unknown. | |

| MRR Last Year | The MRR at the close of December last year. This figure represents the state of the revenue pipeline at the end of the year. | |

| MRR Over Time | The monthly recurring revenue, calculated as: CLI Start Date <= Today and CLI End Date >= Today and Contract Status is not Superseded. | |

| Net New Accounts | The number of net new customer accounts, calculated as: Count of Net New Accounts for contracts with Contract Start Date = Current Quarter. | |

| Open Renewals | The MRR amount of the renewals currently open, calculated as: Sum of CLI MRR (Non-superseded contracts) where the CLI End Date = Current Quarter or Next Quarter and Next Opportunity Name = Unknown. | |

| YTD Renewal Rate | The year to date (YTD) rate of renewal for your subscription bookings, calculated as: 1 - abs(MRR Churn YTD / Sum of CLI MRR YTD). | |

| [Optional] Churn Rate |

The churn rate for your subscription bookings. This KPI is calculated using the following formula: abs(Recurring Revenue Churn / Sum of renewable Contract Line Item Recurring Revenue). |

|

| Average Customer Lifespan |

This is an intermediate calculation used by some KPIs. The average customer lifespan is calculated using the following formula: 1 / Churn Rate |

|

| Customer Lifetime Value (CLV) |

The value in revenue you generate from a customer account. This KPI is calculated using the following formula: CLV = Subscription Revenue value / (Churn Rate * Number of Accounts associated with the subscription revenue) |

|

| Customer Acquisition Cost (CAC) |

The cost of attracting a new customer to your business. This KPI is calculated using the following formula: CAC = Expenses value / Number of Accounts associated with the expenses |

|

| CLV/CAC Ratio | The CLV/CAC ratio compares the value of an average customer over their lifetime with the cost of acquiring it. | |

| Unvouchered Purchase Orders | Total Number of Unreceived Purchase Orders |

The sum of unreceived unvouchered purchase orders (POs) at the moment the dashboard is generated. To calculate the total number of unreceived purchase orders, the system first checks every purchase order line looking for unvouchered items. To do so, the value of the unvouchered items is computed by applying the following formula: If one line of the purchase order fulfills this condition, the rest of the lines in the purchase order are skipped so that the purchase order is not counted more than once. |

| Total Value of Unreceived Purchase Orders | The sum of the value of all unreceived unvouchered purchase orders (POs) at the moment the dashboard is generated. The value of all the items in a PO is considered even if it is not fully received. Partially matched items within a PO are not considered. For each PO line, the system calculates the value of the unreceived unvouchered items by applying the following formula: max(PO line Total Cost - max(PO line Quantity Received, Quantity Vouchered) * PO line Unit Cost With Options,0). This formula covers over-receipt an over-match before receipt cases. Then the total is calculated by adding up the result of each PO line. |

|

| Total Number of Received Purchase Orders |

The sum of fully received unvouchered purchase orders (POs) at the moment the dashboard is generated. To calculate the total number of received purchase orders, the system first checks every purchase order line, looking for unvouchered items. To do so, the value of the unvouchered items is computed by applying the following formula: If one line of the purchase order fulfills this condition, the rest of the lines in the purchase order are skipped so that the purchase order is not counted more than once. |

|

| Total Value of Received Purchase Orders | The sum of the value of all received unvouchered services and goods placed in purchase orders (POs) at the moment the dashboard is generated. This is calculated as: max((PO line Quantity Received - PO line Quantity Vouchered) * PO line Unit Cost With Options), 0). | |

| Purchase Orders by Due Date | Total Value of Unreceived Items in Purchase Order Lines | The sum of the value of all unreceived purchase order line items with a requested delivery date that falls within the selected date range. This is calculated as: sum of (max(Total Cost of PO lines, Quantity Vouchered * Unit Cost With Options) - Quantity Received * Unit Cost With Options) where PO Status = Approved or Drop Ship Approved, PO line Status = Open or Partially Received, and PO line Requested Delivery Date is in the selected date range. |

| Total Number of Purchase Orders with Unreceived Items in Purchase Order Lines | The total number of unreceived purchase orders (POs) containing at least one purchase order line item with a requested delivery date that falls within the selected date range. This is calculated as: number of POs where PO Status = Approved or Drop Ship Approved, PO line Status = Open or Partially Received, and PO line Requested Delivery Date is in the selected date range. |

|

| Purchase Orders Committed Spend | Total Committed Spend in Purchase Orders |

The total value of all unvouchered goods and services in approved purchase orders plus the value of all recurring purchase orders that are pending approval. After that, the system checks if the resulting value is larger than zero and if the PO lines have a requested delivery date that falls within the selected date range. If so, the value is added up to the total. Then, the value of all open recurring purchases orders is also calculated and added up to the total. This is computed by extracting the Total Cost field of each PO line that belongs to a PO where the Status is Open or Revised, the Recurring Purchase Order? field is set to True, and where the PO line Requested Delivery Date is within the selected date range. |

| Committed Spend in Unreceived Purchase Orders |

Total value of unreceived unvouchered goods and services in purchase orders plus the value of all recurring purchase orders that are pending approval. To calculate this value the following elements are used:

These elements are calculated for each PO line where the value for the Requested Delivery Date field falls within the selected date range, and also for every PO where the Recurring Purchase Order? field is set to True, PO line Requested Delivery Date is within the selected date range, and PO Status is Open or Revised. Then, the total is calculated by adding up the result of each PO line. |

|

| Committed Spend in Received Purchase Orders |

Total value of received unvouchered goods and services in purchase orders. This is calculated for each PO line where the value for the Requested Delivery Date field falls within the selected date range. Then, the total is calculated by adding up the result of each PO line. |

|

| Amount Spent in Purchase Orders | Total Amount Vouchered in Purchase Orders | Total value of the vouchered goods and services in purchase orders, calculated as: sum of PO line Quantity Vouchered * PO line Unit Cost with Options when PO line PO Status = Approved, Drop Ship Approved, or Closed. |