The % Complete revenue recognition method relates to fixed fee projects or milestones recognized on percentage of completion. A revenue forecast record is created for each monthly time period to store the values for these objects for use in Revenue Forecasting.

Revenue Forecasting automatically caps the amount at 100% to prevent over-forecasting if the number of hours logged and scheduled on a milestone or project exceeds the number of planned hours, estimated hours at completion, or expected hours.

Revenue Forecasting uses EVAs to calculate the following in a given month:

- Actual percentage of completion.

- Scheduled and unscheduled percentage of completion.

Integration with Revenue Management

Integration with Revenue Management

If you are using the integration between PSA and Revenue Management, records looking up to a template in Revenue Management of type % Complete that fall within the monthly time periods spanning the project duration are included.

If you run Revenue Forecasting after revenue has been recognized, the revenue is moved from the Revenue Pending Recognition field into the Revenue Recognized to Date field on the revenue forecast record for the monthly time period that corresponds to the date the revenue was recognized in Revenue Management.

No Integration with Revenue Management

No Integration with Revenue Management

If you are not using the integration between PSA and Revenue Management, Revenue Forecasting looks at the Recognition Method field on a record, which must have a value of % Complete.

Milestone

A revenue forecast record is created for each month for milestones whose recognition method is set as % Complete. This record stores the values for EVAs and timecards for use in Revenue Forecasting.

If an actual date is recorded on a milestone, when you run a revenue forecast:

- Only actual hours are included and the revenue is split between the actual hours. Any scheduled or unscheduled hours are discounted. In this case, actual hours are used as the total hours instead of planned hours.

- The % Hours Completed for Recognition field on the milestone shows a value of 100%, as the actual date indicates the milestone is complete.

Est Vs Actuals

Est Vs Actuals

EVA records that meet the following criteria are included:

- The Type field in the Time Period lookup has a value of Month.

- For EVA records generated for assignments:

- The assignment record in the Assignment lookup looks up to the corresponding milestone.

- The assignment record in the Assignment lookup has the Billable checkbox set to false, or has the Billable checkbox set to true with a value of zero or null in the Bill Rate field.

- For EVA records generated for held resource requests:

- The records look up to the corresponding milestone.

- The value in the Resource Request Hours field is greater than zero.

- The value in the Resource Request Bill Rate field is null or zero.

- The held resource request does not have an associated assignment.

Scheduled Hours

For assignments, Revenue Forecasting uses the following calculation to work out the number of scheduled hours:

Estimated Hours - Actual Hours

For held resource requests, the value in the Resource Request Hours field on an EVA record represents the number of scheduled hours.

Unscheduled Hours

The following calculation is used to work out the number of unscheduled hours:

Planned Hours - (Actual Hours on Timecards + Scheduled Hours on Resource Requests + Scheduled Hours on Assignments)

Scheduled Revenue

The following calculation is used to work out the Scheduled Revenue percentage for a given month:

(Total Scheduled Hours/Planned Hours) * 100

To work out the Scheduled Revenue amount, the Scheduled Revenue percentage value is multiplied by the value in the Milestone Amount field on the milestone record.

Timecards

Timecards

Timecard records that meet the following criteria are included:

- The Assignment lookup is populated with a value.

- The value in the Status field matches one of the values displayed in the Timecard Statuses field on the Est Vs Actuals custom setting.

- The Approved checkbox is set to true.

- The Billable checkbox is set to false.

- The corresponding milestone is populated in the Milestone lookup.

To work out the Revenue Pending Recognition percentage, the following calculation is used:

(Sum of approved timecard hours/Planned Hours) * 100

To work out the Revenue Pending Recognition amount, the Revenue Pending Recognition percentage is multiplied by the value in the Milestone Amount field on the milestone record.

If you are using the integration between PSA and Revenue Management:

- Revenue Recognized to Date = Sum of the recognized values in a given month, based on the recognition date in Revenue Management.

- Pending Recognition = Revenue Recognized to Date value subtracted from the value on the relevant % Complete: Milestone record that has a revenue type of Actuals in PSA.

- Scheduled Revenue = Value on the relevant % Complete: Milestone record that has a revenue type of Forecast in PSA.

For more information about the fields on a milestone record, see Milestone Fields.

Project

A revenue forecast record is created for each month for projects whose recognition method is set as % Complete. This record stores the values for EVAs and timecards for use in Revenue Forecasting.

When you run a revenue forecast for a project, the following calculation is used to work out the total Revenue Forecast percentage for a given month:

Revenue Pending Recognition percentage + Scheduled Revenue percentage

A project is considered to be closed if the value in the Stage field on a project is "Completed" or the Closed for Time Entry checkbox is selected when you run a revenue forecast:

- Only actual hours are included and the revenue is split between the actual hours. Any scheduled or unscheduled hours are discounted.

- The % Hours Completed for Recognition field on the project shows a value of 100%, as the project is complete.

Est Vs Actuals

Est Vs Actuals

EVA records that meet the following criteria are included:

- The Type field in the Time Period lookup has a value of Month.

- For EVA records generated for assignments, the assignment record in the Assignment lookup has the Billable checkbox set to false, or has the Billable checkbox set to true with a value of zero or null in the Bill Rate field.

- For EVA records generated for held resource requests:

- The value in the Resource Request Hours field is greater than zero.

- The value in the Resource Request Bill Rate field is null or zero.

- The held resource request does not have an associated assignment.

Scheduled Hours

For assignments, Revenue Forecasting uses the following calculation to work out the number of scheduled hours:

Estimated Hours - Actual Hours

For held resource requests, the value in the Resource Request Hours field on an EVA record represents the number of scheduled hours.

Unscheduled Hours

The following calculation is used to work out the number of unscheduled hours:

Estimated Hours at Completion - (Actual Hours on timecards + Scheduled Hours on resource requests + Scheduled Hours on assignments)

Scheduled Revenue

The following calculation is used to work out the Scheduled Revenue percentage for a given month:

(Total Scheduled Hours/Estimated Hours at Completion) * 100

To work out the Scheduled Revenue amount, the Scheduled Revenue percentage value is multiplied by the value in the Bookings field on the project record.

Timecards

Timecards

Timecard records that meet the following criteria are included:

- The Assignment lookup is populated with a value.

- The value in the Status field matches one of the values displayed in the Timecard Statuses field on the Est Vs Actuals custom setting.

- The Approved checkbox is set to true.

- The Billable checkbox is set to false.

To work out the Revenue Pending Recognition percentage, the following calculation is used:

(Sum of approved timecard hours/Estimated Hours at Completion) * 100

To work out the Revenue Pending Recognition amount, the Revenue Pending Recognition percentage is multiplied by the value in the Bookings field on the project record.

If you are using the integration between PSA and Revenue Management:

- Revenue Recognized to Date = Sum of the recognized values in a given month, based on the recognition date in Revenue Management.

- Pending Recognition = Revenue Recognized to Date value subtracted from the value on the relevant % Complete: Project record that has a revenue type of Actuals in PSA.

- Scheduled Revenue = Value on the relevant % Complete: Project record that has a revenue type of Forecast in PSA.

For more information about the fields on a project record, see Project Fields.

Calculating with Closed Periods

This section explains how the revenue forecasts are calculated when relevant records are marked as % Complete and there are closed time periods within the project or milestone duration.

Integration with Revenue Management

Integration with Revenue Management

If you are using the integration between PSA and Revenue Management and you run a revenue forecast on an open project, actual revenue is treated in the following way when there are closed monthly time periods:

- Closed period, full amount recognized: the full amount is displayed in the Revenue Recognized to Date field on the revenue forecast record for the closed time period.

- Closed period, partial amount recognized: the part that has been recognized is displayed in the Revenue Recognized to Date field on the revenue forecast record for the closed time period. The remainder is displayed in the Revenue Pending Recognition field on the revenue forecast record for the next open time period.

- No open time period within project or milestone duration: a revenue forecast record is created for the next available open time period and the revenue is displayed in the Revenue Pending Recognition field on this record. If the revenue is subsequently recognized and you run Revenue Forecasting again, the revenue is moved into the Revenue Recognized to Date field on the revenue forecast record for the time period that corresponds to the date the revenue was recognized in Revenue Management.

If a project is open and there are closed periods containing scheduled or unscheduled hours within the project or milestone duration:

- Closed period: any scheduled hours in the closed period become unscheduled. The revenue from the unscheduled hours is spread evenly between open monthly time periods that do not contain any scheduled or actual revenue, with the exception of empty months that fall between months containing scheduled or actual hours. If all monthly time periods in the project or milestone duration contain scheduled or actual revenue, the revenue that has become unscheduled is moved into:

- The final monthly time period within the project duration for projects.

- The monthly time period that contains the target date or, if populated, the actual date for milestones. If the milestone target date or actual date falls outside the project duration, the project end date is used instead.

- All periods closed in project or milestone duration: any scheduled or unscheduled revenue is ignored by Revenue Forecasting.

No Integration with Revenue Management

No Integration with Revenue Management

If you are not using the integration between PSA and Revenue Management and you run a revenue forecast, the revenue is treated in the following way when a project is open or a milestone is not complete and there are closed periods within the project or milestone duration:

- Closed period: any scheduled hours in the closed period become unscheduled. The revenue from the unscheduled hours is spread evenly between open monthly time periods that do not contain any scheduled or actual revenue, with the exception of empty months that fall between months containing scheduled or actual hours. If all monthly time periods in the project or milestone duration contain scheduled or actual revenue, the revenue that has become unscheduled is moved into:

- The final monthly time period within the project duration for projects.

- The monthly time period that contains the target date or, if populated, the actual date for milestones. If the milestone target date or actual date falls outside the project duration, the project end date is used instead.

- All periods closed in project or milestone duration: any scheduled or unscheduled revenue is ignored by Revenue Forecasting.

Including Unscheduled Hours

PSA identifies a month as having scheduled hours if it contains at least one Est Vs Actuals (EVA) record.

If there are any unscheduled hours on a project or milestone and there are months that do not contain any scheduled or actual hours, the revenue from the unscheduled hours is spread evenly across those months, with the exception of empty months that fall between months containing scheduled or actual hours.

If there are unscheduled hours on a project or milestone and all relevant months contain scheduled or actual hours, the revenue from the unscheduled hours is added to:

- The final month within the project duration for projects.

- The month that contains the target date or, if populated, the actual date for milestones.

If the milestone target date or, if populated, the milestone actual date falls outside the project duration, the project end date is used instead.

Unscheduled revenue is displayed in the Unscheduled Revenue field on the revenue forecast and revenue forecast type records.

On projects, the following calculation is used to work out the number of unscheduled hours:

Estimated Hours at Completion - (Actual Hours on timecards + Scheduled Hours on resource requests + Scheduled Hours on assignments)

On milestones, the following calculation is used to work out the number of unscheduled hours:

Planned Hours - (Actual Hours on Timecards + Scheduled Hours on Resource Requests + Scheduled Hours on Assignments)

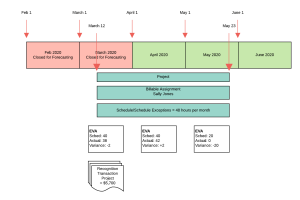

Example for % Complete Recognition Method

An active fixed fee project has the following attributes:

An active fixed fee project has the following attributes:

- Start Date = March 12.

- End Date = May 23.

- Bookings = $18,000.

- Total Hours = 120 (taken from field specified in Total Hours Field on Project picklist in Revenue Forecast Setup).

- Recognition Method = % Complete.

- The monthly time period records for February and March have the Closed for Forecasting checkbox set to true.

There is one assignment with the following attributes:

- Assigned to resource: Sally Jones.

- Bill Rate = $0.

- Start Date = March 12.

- End Date = May 23.

- Total scheduled hours = 100.

- Schedule or schedule exceptions are:

- 40 hours in March.

- 40 hours in April.

- 20 hours in May.

The following diagram gives details of the dates, time periods, and records included in the forecast.

When Revenue Forecasting is run on the project, the following fields are updated on the revenue forecast records relating to each monthly time period.

|

Field |

$ Revenue | ||

|---|---|---|---|

| March | April | May | |

| Revenue Recognized To Date | $5,700 | $0 | $0 |

| Revenue Pending Recognition | $0 | $6,300 | $0 |

| Scheduled Revenue | $0 | $0 | $3,000 |

| Unscheduled Revenue | $0 | $0 | $3,000 |

The following revenue forecast type records are created.

| $ Value in Revenue Forecasting Fields | ||||

|---|---|---|---|---|

| Revenue Source | Revenue Forecast Type | March |

April |

May |

| % Complete: Project | Actual |

Revenue Recognized To Date: $5,700 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $6,300 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

| % Complete: Project | Forecast |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $3,000 Unscheduled Revenue: $3,000 |

Notes

In March, only 38 of the 40 scheduled hours were submitted and approved in timecards. The amount in Revenue Pending Recognition is (38/120) * 18,000 = $5,700. As the full amount is recognized, no revenue rolls into April when the March time period is closed.

The scheduled revenue for the remaining two hours in March is ignored when the period is closed.

In April, Sally Jones works two hours more than scheduled to make up for March. 120 hours is still the total hours for the project, so in Revenue Pending Recognition there is (42/120) * 18,000 = $6,300. As the number of timecard hours exceeds the number of scheduled hours, there is no scheduled revenue in April.

In May, there are 20 scheduled hours, which means the amount in Scheduled Revenue is (20/120) * 18,000 = $3,000.

The whole project has only 100 hours out of the total planned 120 hours in timecards or schedules. The remaining 20 hours corresponds to $3,000 of revenue, which goes into the first period that does not contain any actual or scheduled hours, or the last period in the project if there are no periods without any actual or scheduled hours. In this example, the $3,000 goes into Unscheduled Revenue in May.