Deliverable Recognition Method

The Deliverable revenue recognition method relates to projects and opportunities containing records that are recognized on delivery, for example Time and Materials projects or fixed price projects with deliverable milestones. Records from the objects listed in this topic, such as Expense and Milestone, are included in revenue forecast calculations.

A revenue forecast record is created for each monthly time period to store the values for each of the objects for use in Revenue Forecasting. For each revenue source, such as expenses, a revenue forecast type record is only created if there are qualifying records within the months spanning the project duration.

Integration with Revenue Management

Integration with Revenue Management

If you are using the integration between PSA and Revenue Management, records looking up to a template in Revenue Management of type "Deliverable" that fall within the monthly time periods spanning the project duration are included, with the exception of Est Vs Actuals (EVA) records. EVA records only need to meet the criteria listed below.

If you run Revenue Forecasting after revenue has been recognized, the revenue is displayed in the Revenue Recognized to Date field on the revenue forecast record for the monthly time period that corresponds to the date the revenue was recognized in Revenue Management.

No Integration with Revenue Management

No Integration with Revenue Management

If you are not using the integration between PSA and Revenue Management, Revenue Forecasting looks at the Recognition Method field on a record, which must have a value of "Deliverable".

Records Included in Revenue Forecasting Calculations

Est Vs Actuals

Est Vs Actuals

Includes scheduled hours for the resources assigned to the project, taking into account the hours and bill rates associated with those resources.

EVA records that meet the following criteria are included:

- The Type field in the Time Period lookup has a value of Month.

- The time period set on the EVA falls between the project start and end date, or overlaps one of those dates.

-

For EVA records generated for assignments, the assignment record in the Assignment lookup has:

- The Billable checkbox selected.

- A value in the Bill Rate field that is not zero or null.

-

For EVA records generated for held resource requests:

- The value in the Resource Request Hours field is greater than zero.

- The value in the Resource Request Bill Rate field is greater than zero.

- The held resource request does not have an associated assignment.

For assignments, the following calculations are used to work out the number of scheduled hours or days:

- Estimated Hours - Actual Hours (if the Scheduled Bill Rate is Daily Rate checkbox is deselected)

- Estimated Days - Actual Days (if the Scheduled Bill Rate is Daily Rate checkbox is selected)

The following calculation is used to work out the scheduled revenue:

Scheduled Hours or Scheduled Days * Scheduled Bill Rate

For held resource requests, Revenue Forecasting calculations use the value in the Resource Request Hours field multiplied by the value in the Resource Request Bill Rate field.

The value in the Scheduled Revenue field on each revenue forecast type record is calculated using values taken from the monthly EVA records that fall within the same time period as the revenue forecast.

For more information about the fields on an EVA record, see Estimates Versus Actuals Fields.

When calculating the revenue for assignments and resource requests, PSA uses the values in the following fields by default:

- The Bill Rate field on an assignment record.

- The Resource Request Bill Rate field on related EVA records.

If required, you can configure PSA to use the values in different fields on assignment or resource request records instead of the default fields. This affects the revenue forecasts in the following way:

- Only EVA records containing a value or zero in the nominated fields are included.

- The following calculation is used to work out the revenue for a monthly time period:

Total hours or days on the EVA record * Value in the nominated assignment or resource request fields

For information on how to set up PSA to use nominated fields instead of the default bill rate fields, see Specifying the Fields to Use Instead of Bill Rate on Assignments and Resource Requests (Deliverable Revenue).

Expense

Expense

Expense records that meet the following criteria are included:

- The Approved checkbox is selected.

- The Billable checkbox is selected.

- The value in the Expense Date field falls within a monthly time period of a revenue forecast.

The Revenue Pending Recognition field on each revenue forecast type record contains the sum of the values in the Billable Amount field for all expense records in a given month.

For more information about the fields on an expense record, see Expense Entry Page Fields.

Milestone

Milestone

For completed milestones, milestone records that meet the following criteria are included:

- The Approved checkbox is selected.

- The Exclude from Billing checkbox is deselected.

- The value in the Actual Date field falls within a monthly time period of the revenue forecast.

The Revenue Pending Recognition field on the revenue forecast type record contains the sum of the values in the Milestone Amount field for all completed milestone records in a given month.

For scheduled milestones, milestone records that meet the following criteria are included:

- The Approved checkbox is deselected or the Actual Date field is blank.

- The Exclude from Billing checkbox is deselected.

- The value in the Target Date field falls within a monthly time period of the revenue forecast.

The Scheduled Revenue field on the revenue forecast type record contains the sum of the values in the Milestone Amount field for all scheduled milestone records in a given month.

For more information about the fields on a milestone record, see Milestone Fields.

Miscellaneous Adjustment

Miscellaneous Adjustment

Miscellaneous adjustment records that meet the following criteria are included:

- The Approved checkbox is selected.

- The Exclude from Billing checkbox is deselected.

- The value in the Effective Date field falls within a monthly time period of a revenue forecast.

The Revenue Pending Recognition field on the revenue forecast type record contains the sum of the values in the Amount field for all miscellaneous adjustment records within a given month.

For more information about the fields on a miscellaneous adjustment record, see Miscellaneous Adjustment Fields.

Resource Request

Resource Request

When calculating resource request revenue on opportunities:

- The associated revenue forecast type record has a revenue source of "Opportunity" and a revenue type of "Forecast".

- The revenue is included in the Unscheduled Revenue field on the revenue forecast type record.

- The value in the Unscheduled Revenue field on the revenue forecast type record is rolled up into the related revenue forecast record.

For more information on viewing revenue forecast type records, see Viewing Revenue Forecast Records.

If an opportunity has opportunity products, the value in the Unscheduled Revenue field on the revenue forecast type record is the sum of all opportunity product line items where the Is Services Product Line checkbox is selected, multiplied by the value in the Probability (%) field if probability is used.

If an opportunity has no associated opportunity products, the value in the Unscheduled Revenue field on the revenue forecast type record is calculated using the value in the Amount field on the opportunity, multiplied by the value in the Probability (%) field if probability is used.

If an opportunity has associated resource requests and Include RRs on Opportunities is selected on the active revenue forecast setup record, the calculated resource request revenue is displayed in the Unscheduled Revenue field on the revenue forecast type record.

Revenue Forecasting does the following:

- Subtracts the resource request revenue from the total revenue amount on the opportunity (including revenue for opportunity products). This is because revenue from resource requests is part of the opportunity and not additional revenue.

- Splits the remainder equally between the months that fall between expected opportunity start and end dates.

This means the total unscheduled revenue on the opportunity does not change but the distribution of the revenue differs based on the resource requests.

Records with No Associated Schedule

For resource requests without an associated schedule, if Include RRs on Opportunities is selected on the active revenue forecast setup record and the bill rate is not zero, the revenue is split equally across the days that are within the resource request's date range (based on the resource request start and end date).

The revenue for each resource request is calculated in the following way:

Average hours per day * Number of days in a month * Bill rate

Example

Opportunity details:

- Opportunity amount = $2000

- Expected opportunity start date = September 1

- Expected opportunity end date = December 31

Resource request details:

- Bill rate = $10

- Requested hours = 106

- Request billable amount = $1060

The resource request covers the following number of days in each month:

- September: 7

- October: 31

- November: 15

- Total number of days = 53

Average hours per day is 106 / 53 = 2

The following forecasted unscheduled revenue is calculated:

- September: $140

- October: $620

- November: $300

- Total unscheduled revenue = $1060

The remaining revenue on the opportunity is $940. This is split equally between the expected opportunity start date and the expected opportunity end date, which span four months.

940 / 4 = $235

Total revenue forecast:

- September = $235 + $140 = $375

- October = $235 + $620 = $855

- November = $235 + $300 = $535

- December = $235

- Total revenue forecast = $2000

If Exclude Probability from Opportunities is not selected on the active revenue forecast setup record, the monthly revenue for each resource request is calculated in the following way to take account of probability:

Average hours per day * Number of days in the month * Bill rate * (Opportunity probability / 100)

Records with an Associated Schedule

For resource requests with an associated schedule, if Include RRs on Opportunities is selected on the active revenue forecast setup record, resource request records that meet the following criteria are included in opportunity revenue forecast calculations:

- The Preferred Schedule field looks up to a schedule showing hours.

- The bill rate is not zero.

The schedule determines how many hours there are within each monthly time period. The monthly revenue for each resource request is calculated in the following way:

Number of hours in the month from schedule * Bill rate

If Exclude Probability from Opportunities is not selected on the active revenue forecast setup record, the monthly revenue for each resource request is calculated in the following way to take account of probability:

Number of hours in the month from schedule * Bill rate * (Opportunity probability / 100)

Notes

The following are excluded from opportunity forecast calculations:

- Days that are within the date range of the opportunity but outside the resource request date range.

- Days that are within the date range of the resource request but outside the opportunity date range.

Excluding Resource Request Records

You can configure Revenue Forecasting to exclude specific records that have the checkbox you nominate selected. For more information, see Excluding Selected Assignments and Resource Requests (Deliverable and Fixed Fee Revenue).

Controlling the Bill Rate

By default, Revenue Forecasting uses the value in the Suggested Bill Rate Number field to calculate the revenue for resource requests or, if that field is blank, the value in the Requested Bill Rate field.

If required, you can configure Revenue Forecasting to use the value in a field you nominate as the bill rate instead of using the default fields. This affects the revenue forecast calculations in the following way:

- Only resource request records containing a value or a zero in the nominated field are included.

- The following calculation is used to work out the revenue for a monthly time period:

Total hours or days on the resource request record * Value in the nominated resource request field

For information on how to set up Revenue Forecasting to use a nominated bill rate field, see Specifying the Fields to Use Instead of Bill Rate on Assignments and Resource Requests (Deliverable Revenue).

Identifying the Currency

When including resource request revenue in opportunity revenue forecasts, if the resource request currency does not match the opportunity currency, Revenue Forecasting converts the resource request currency to the opportunity currency using the exchange rate from the day the forecast is run. Currency conversion is applied up to the end date of the associated resource request schedule.

When calculating the revenue, the following rules apply regarding currency conversion:

- Revenue Forecasting uses the currency in the Suggested Bill Rate Currency Code field if the value in the Suggested Bill Rate field is being used in the forecast calculations.

-

Revenue Forecasting uses the currency in the Currency Code field if one of the following is true:

- The value in a nominated field is being used as the bill rate for forecast calculations. For more information, see Controlling the Bill Rate.

- The Suggested Bill Rate Currency field is blank.

- The value in the Requested Bill Rate field is being used for forecast calculations.

For more information on currency conversions in Revenue Forecasting, see Revenue Forecasting Exchange Rates.

Timecard

Timecard

Timecard split records that meet the following criteria are included:

- The value in the Status field matches one of the values displayed in the Timecard Statuses field on the Est Vs Actuals custom setting.

- The Billable checkbox is selected.

- The values in the Start Date and End Date fields fall within a monthly time period of a revenue forecast.

The Revenue Pending Recognition field on the revenue forecast type record contains the sum of the Total Billable Amount for all timecard split records in a given month.

For more information about the fields on a timecard record, see Timecard Entry Fields.

Calculating Accurate Mid Month Forecasts

On the active revenue forecast setup record, you can select Use Mid Month Forecast Calculations and specify a cutoff day. Revenue Forecasting then excludes past scheduled hours that are not covered by timecards from calculations for the current monthly time period (forecasts run for other months are not affected). This means:

- Scheduled work that never took place is excluded.

- Forecast calculations exclude such scheduled work on a weekly basis instead of on a monthly basis, aligning with the typical timecard submission cadence.

This setting brings the following benefits:

- There is a smoother progression through the month, with no sudden change in forecasting values at month end.

- You have a more accurate representation of the remaining planned work and the completed planned work for the current month. Forecasts run for other months are not affected.

The following rules apply:

- If an assignment uses a daily bill rate, a day is treated as a working day if the number of hours is greater than 0. Hours to days rules are not currently respected.

- If an assignment uses a daily bill rate and there are actual hours from timecards for that day, Revenue Forecasting includes the day in the forecast as an actual day.

- Revenue Forecasting excludes scheduled hours that fall on or before the actuals cutoff day you select.

- If the actual hours recorded for a day exceed the scheduled hours, Revenue Forecasting excludes all scheduled revenue for that day.

For more information, see Configuring Mid Month Forecasting Calculations (Deliverable and % Complete Revenue).

Example for Accurate Mid Month Forecasting

Example for Accurate Mid Month Forecasting

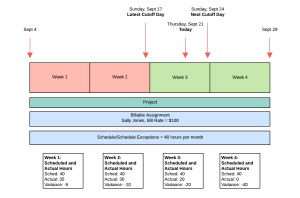

An active time and materials project has the following attributes:

- Start Date = September 4.

- End Date = September 29.

- Timecard split and expense records are set up to be recognized on delivery.

There is one assignment with the following attributes:

- Assigned to resource: Sally Jones.

- Bill Rate = $100 per hour.

- Start Date = September 4.

- End Date = September 29.

- Total scheduled hours = 160.

-

Schedule or schedule exceptions are:

- 40 hours in Week 1.

- 40 hours in Week 2.

- 40 hours in Week 3.

- 40 hours in Week 4.

Today's date is Thursday, September 21.

The Actuals Cutoff Day setting is set to Sunday on the active revenue forecast setup record. This means Revenue Forecasting excludes scheduled hours that fall on or before Sunday, 17 September.

The following timecards have been approved for Sally Jones:

- 35 hours in Week 1 = $3,500.

- 30 hours in Week 2 = $3,000.

- 20 hours in Week 3 (Monday to Wednesday) = $2,000.

The following diagram shows what happens when you select Use Mid Month Forecast Calculations and select Sunday as the cutoff day in the active revenue forecast setup record.

The following table shows the difference between selecting and deselecting Use Mid Month Forecast Calculations.

| Fields | Use Mid Month Forecast Calculations | |

|---|---|---|

| Deselected | Selected | |

| Revenue Recognized To Date | $0 | $0 |

| Revenue Pending Recognition | $8,500 | $8,500 |

| Scheduled Revenue | $7,500 | $6,000 |

| Unscheduled Revenue | $0 | $0 |

Notes

Unused scheduled hours that are not reflected by timecards up to the latest cutoff day (Sunday, September 17) are removed from the scheduled revenue. This means:

- 5 hours from Week 1 are no longer included in the forecast = $500.

- 10 hours from Week 2 are no longer included in the forecast = $1,000.

Unused scheduled hours in current and future weeks are still forecast until the next cutoff day of Sunday, September 24 is reached.

The 20 unused hours in the current week will be removed from the forecast if not covered by suitable timecards by the end of the day on Sunday, September 24.

Calculating with Closed Periods

This section explains how the revenue forecasts are calculated when relevant records are marked as Deliverable and there are closed time periods within or after the project duration.

Integration with Revenue Management

Integration with Revenue Management

If you are using the integration between PSA and Revenue Management, when you run a revenue forecast, the revenue is treated in the following way when there are closed monthly time periods:

- Closed period, full amount recognized: the full approved billable amount is displayed in the Revenue Recognized to Date field on the revenue forecast record for the closed time period.

- Closed period, partial amount recognized: the part of the approved billable amount that has been recognized is displayed in the Revenue Recognized to Date field on the revenue forecast record for the closed time period. The remainder is displayed in the Revenue Pending Recognition field on the revenue forecast record for the next open time period.

- No open time period within project duration: a revenue forecast record is created for the next available open time period and any revenue that has not been recognized is displayed in the Revenue Pending Recognition field on this record. If the revenue is subsequently recognized and you run Revenue Forecasting again, the revenue is moved into the Revenue Recognized to Date field on the revenue forecast record for the time period that corresponds to the date the revenue was recognized in Revenue Management.

No Integration with Revenue Management

No Integration with Revenue Management

If you are not using the integration between PSA and Revenue Management and you run a revenue forecast, the revenue is treated in the following way when there are closed monthly time periods:

- Actual revenue is displayed in the Revenue Pending Recognition field on the revenue forecast record.

- Any scheduled or unscheduled revenue is ignored.

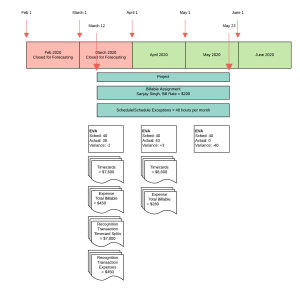

Example for Deliverable Recognition Method

An active time and materials project has the following attributes:

An active time and materials project has the following attributes:

- Start Date = March 12.

- End Date = May 23.

- Timecard split and expense records are set up to be recognized on delivery.

- The monthly time period records for February and March have the Closed for Forecasting checkbox selected.

There is one billable assignment with the following attributes:

- Assigned to resource: Sanjay Singh.

- Bill Rate = $200.

- Start Date = March 12.

- End Date = May 23.

- Total scheduled hours = 120.

- Schedule or schedule exceptions = 40 hours per month.

The following diagram gives details of the dates, time periods, and records included in the forecast.

When Revenue Forecasting is run on the project, the following fields are updated on the revenue forecast records relating to each monthly time period.

| Field | $ Revenue | ||

|---|---|---|---|

| March | April | May | |

| Revenue Recognized To Date | $7,450 | $0 | $0 |

| Revenue Pending Recognition | $0 | $9,480 | $0 |

| Scheduled Revenue | $0 | $0 | $8,000 |

| Unscheduled Revenue |

$0 | $0 | $0 |

The following revenue forecast type records are created.

| $ Value in Revenue Forecasting Fields | ||||

|---|---|---|---|---|

| Revenue Source | Revenue Forecast Type | March | April | May |

| Deliverable EVA | Forecast |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $8,000 Unscheduled Revenue: $0 |

| Deliverable Expense | Actual |

Revenue Recognized To Date: $450 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $280 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

| Deliverable Timecard | Actual |

Revenue Recognized To Date: $7,000 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $9,200 Scheduled Revenue: $9,200 Unscheduled Revenue: $0 |

Revenue Recognized To Date: $0 Revenue Pending Recognition: $0 Scheduled Revenue: $0 Unscheduled Revenue: $0 |

Notes

The March time period is closed for forecasting. No billable timecards have been approved for the two scheduled hours that are outstanding in March (see diagram above). These scheduled hours are ignored by Revenue Forecasting.

In March, the expected $7,600 revenue from timecards does not match what the revenue manager has recognized. The March time period is closed for forecasting, so the remaining $600 moves to the April time period to be recognized together with the revenue from the April timecards.

In April, Sanjay logged more time than was scheduled, so there is no scheduled revenue for this month.