A forecast curve allows you to divide anticipated revenue over a series of sequences of time in a larger time period (such as a quarter). You can define forecast curves on the following:

The forecast curve is made up of a number of forecast curve details, or points on the curve, each covering a certain number of days (Period) and indicating the percentage of the total forecast amount to apply during that period (Percent Burndown).

A forecast curve is basically a delivery schedule you can build, based on how your business typically performs.

For information on creating forecast curves, see Managing Curves for Forecast Calculations.

Forecast curve data is stored in the Forecast Curve and Forecast Curve Detail objects. For more information, see:

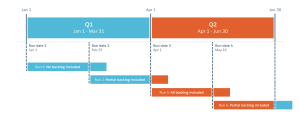

A forecast curve is set on a project that spans Quarter 2 (Q2). The forecast curve is configured as follows:

The length of the curve is the sum of the Lag and the Periods set on the curve details = 60 days.

The Q2 forecast calculation is run four times: on January 1, February 15, April 1, and May 16.

January 1 + 60 days = March 1

Unscheduled backlog forecast = 0%

As January 1 does not fall within the Q2 time period, no unscheduled backlog is included in the forecast calculation.

Feb 15 + 60 days = April 16

Unscheduled backlog forecast = 6%

As 16 days of the curve fall within the Q2 time period, only part of the unscheduled backlog is included in the forecast calculation.

April 1 + 60 days = May 30

Unscheduled backlog forecast = 100%

As both the forecast run date and the curve end date fall within the Q2 time period, all of the unscheduled backlog is included in the forecast calculation.

May 16 + 60 days = July 15

Unscheduled backlog forecast = 40%

As 45 days of the curve fall within the Q2 time period, only part of the unscheduled backlog is included in the forecast calculation.

The following diagram shows what is included in each run:

We take the weighted opportunity value and then project the delivery based on a curve that you apply to one of the following:

Weighted value of opportunity (opportunity value * probability percentage) = $10,000

Projected close date = January 1.

The business typically delivers a project over the following duration:

The forecast curve reflects this delivery pattern:

Related Concepts

Enhanced Services Forecasting Overview

About Services Revenue Forecast Overrides

How Forecast Calculations Work

Related Tasks

Managing Curves for Forecast Calculations

Configuring Forecast Calculations

Overriding Services Revenue Forecast Values

Scheduling Forecast Calculations

Viewing a Services Revenue Forecast

Committing a Services Revenue Forecast

Performing Enhanced Services Forecasting Upgrade Tasks Summer 2018

Updating Enhanced Services Forecasting Data Spring 2019

Reference

Forecast Calculation Log Fields

Forecast Detail Category Fields

Forecast Setup Category Fields